A legendary oil and gas entrepreneur, T. Boone Pickens is now on a mission to enhance U.S. energy policies to lessen the nation’s dependence on OPEC oil. Watch on TED https://www.ted.com/talks/t_boone_pickens_let_s_transform_energy_with_natural_gas?utm_campaign=tedspread&utm_medium=referral&utm_source=tedcomshare

Nobody ever forgets the first time they realize their family’s old gas-guzzler is part of a global drama. For me, it was a holiday road trip—Dad grumbling about oil prices while NPR explained how ‘our enemies’ get rich every time we fill up. That memory stuck: energy isn’t just about powering lights, but about power itself—over borders, budgets, and the very air we breathe. Today, let's unravel the wild, sometimes absurd, story of the U.S. hunt for energy independence: part epic, part cautionary tale, and always oddly personal.

Why the U.S. Can’t Escape the Shadow of Oil (and Why It Matters)

For over a century, oil has shaped the American story—fueling cars, powering industry, and driving foreign policy. Despite talk of U.S. energy independence, the country remains deeply tethered to global oil markets, especially those controlled by OPEC. This dependency isn’t just about economics; it’s a matter of national security, global influence, and everyday life at the pump.

OPEC Oil Dependency: The $1 Trillion Annual Outflow

Every year, the U.S. sends a staggering $1 trillion to OPEC nations to keep its oil flowing. Since 1976, that adds up to $7 trillion—a sum described as

"the greatest transfer of wealth from one group to another in the history of mankind."

This outflow props up rival economies and leaves the U.S. exposed to price shocks and political instability abroad. OPEC’s control over pricing and supply means American wallets are always at risk, no matter how much domestic oil is pumped.

Military Muscle: Securing Oil with Aircraft Carriers

America’s oil imports dependency isn’t just a trade issue—it’s a military commitment. Of the world’s 12 aircraft carriers, 11 fly the U.S. flag, and five are stationed in the Middle East. Their mission? Keep shipping lanes open and oil moving. This deployment underscores how energy policy and national security are intertwined. The U.S. acts as the world’s “oil policeman,” ensuring global supply chains stay intact—often at enormous cost.

America’s Outsized Oil Appetite

The numbers are stark: the U.S. has just 4% of the world’s population but consumes 25% of global oil—about 20 million barrels per day. While domestic production has surged, U.S. refineries still rely on imported heavy crude, especially from OPEC. This means true energy independence remains elusive, and the U.S. continues to import about 12 million barrels daily, with 5 million coming from OPEC.

National Security and Political Promises

Every election cycle, candidates promise to end America’s “addiction” to foreign oil. Yet, as history shows, energy independence is a perennial political bait. The reality: as long as transportation—responsible for 70% of U.S. oil use—runs on petroleum, imports will continue. Military deployments and massive payments to OPEC are the price of this dependency.

From Wartime Rationing to Modern Sticker Shock

Ask any grandparent about wartime oil rationing, and you’ll hear stories of hardship and sacrifice. Fast forward to today, and Americans still feel the pinch—only now it’s at the gas station, where prices spike with every global crisis. The shadow of oil looms as large as ever.

Table Preview: U.S. Oil Imports, Use, and Population Over Time

Year | Population (%) | Oil Consumption (M bbl/day) | Imports (M bbl/day) | OPEC Share (M bbl/day) |

|---|---|---|---|---|

1976 | ~5% | 17 | 8 | 4 |

2023 | 4% | 20 | 12 | 5 |

America’s oil story is one of ambition, risk, and relentless demand—a story that continues to shape its economy, security, and global standing.

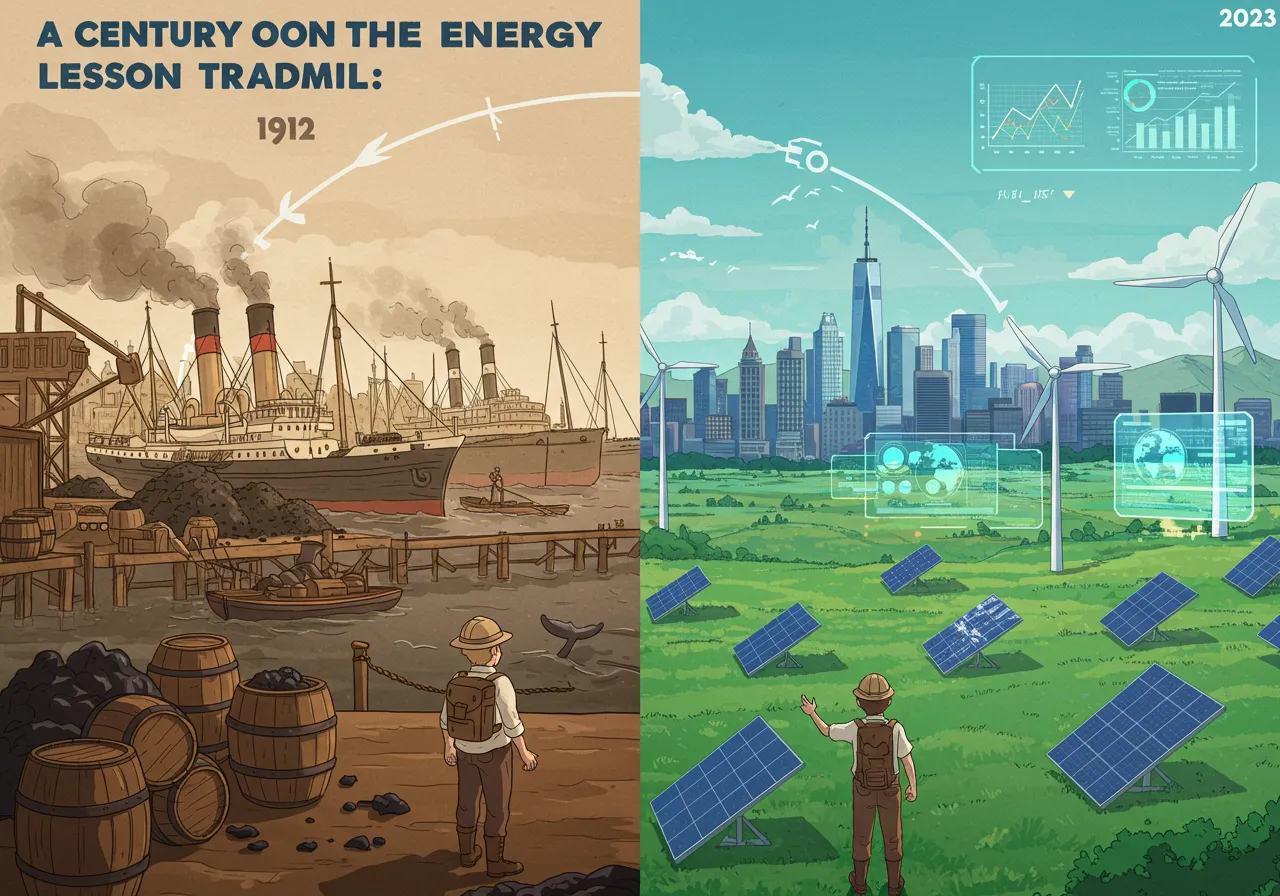

A Century on the Energy Treadmill: Lessons from 1912, Whale Oil, and Wild Optimism

History has a way of circling back, especially when it comes to energy policy and the quest for U.S. energy independence. In 1912, America stood at a crossroads that feels eerily familiar today. Back then, the nation was moving away from whale oil and coal, searching for something cleaner and cheaper. The answer? Crude oil—abundant, affordable, and, crucially, foreign. This decision was driven by necessity, short-term economics, and a healthy dose of optimism about the future.

Fast forward a century, and the U.S. faces another pivotal moment. The question now: can we finally break the cycle and shift from imported oil to cleaner, domestic fuels? The stakes are high. As in 1912, the choices we make today will shape our economy, environment, and security for decades to come.

Decision Points: Messy, Hopeful, and Full of Surprises

Energy transitions are rarely neat. The switch from whale oil to crude oil was hailed as progress, but it came with unintended consequences—new dependencies, new environmental costs, and a new set of global entanglements. Today’s decision point is no different. While natural gas and renewables offer cleaner alternatives, the path forward is loaded with uncertainty and blind optimism.

A Roaring ‘20s Flapper Meets Fracking and Teslas

Imagine a flapper from the Roaring ‘20s, bobbed hair and all, stepping into 2024. She’d marvel at Teslas gliding silently down highways and the idea of extracting energy from shale rock. But she might also recognize the same wild optimism and faith in technology that fueled her own era’s energy dreams. The lesson? Every generation believes it’s on the verge of solving the energy puzzle—until the next crisis hits.

Cheap Oil Is Over: The New Economics of Energy

For decades, cheap oil shaped U.S. energy policy and global markets. That era is ending. As one industry leader bluntly put it:

"Cheap oil’s days are over. They make it very clear to you, the Saudis do."

Saudi Arabia now needs oil prices at $94 per barrel just to fund its social commitments—not because production costs are high, but because their national budgets depend on it. There is no true free market for oil; OPEC nations set the price, and the world pays. This reality is forcing a rethink of future transportation fuels 2040 and beyond.

Today, the U.S. uses about 20 million barrels of oil daily—25% of global demand—with only 4% of the world’s population.

Most of this oil powers transportation, making it the key battleground for energy independence.

Since 1976, the U.S. has transferred $7 trillion to OPEC—one of history’s greatest wealth shifts.

As cheap oil fades, the pressure to develop domestic, cleaner fuels grows. The lesson from 1912? Economics, environment, and optimism always shape our choices—but reality eventually forces change, ready or not.

Natural Gas: Saviour, Sideshow, or Just a Bridge?

When it comes to U.S. energy independence, natural gas has moved from underdog to center stage. With oil prices set by OPEC and global markets, the U.S. has turned to natural gas as a homegrown alternative. But is it our saviour, a temporary sideshow, or simply a bridge to something better?

The Case for Natural Gas

Cleaner Burning: Natural gas is about 25% cleaner than oil, offering a significant reduction in carbon emissions per unit of energy.

High Octane, Low Hassle: With a 130 octane rating, it’s a powerhouse fuel that requires minimal refining. As one industry veteran puts it, “It comes out of the ground at one hundred and thirty octane, run it through a separator, and you’re ready to use it.”

Versatility: Natural gas powers electricity generation, heats homes, and—crucially—can fuel heavy-duty trucks.

Massive U.S. Natural Gas Reserves

The U.S. is sitting on an energy goldmine. U.S. natural gas reserves are estimated at 4,000 trillion cubic feet—three times what Saudi Arabia claims in oil reserves. As one expert notes:

"We've got 4,000 trillion cubic feet of natural gas that's available to us."

This abundance is thanks to advances in fracking and horizontal drilling, unlocking formations like the Barnett Shale in Texas, Marcellus in the Northeast, and Haynesville in Louisiana. The result? “We are overwhelmed with natural gas.”

Targeting Heavy-Duty Trucking: A Game Changer

One of the most compelling uses for natural gas is in heavy-duty trucking. The U.S. has around 8 million of these 18-wheelers. If they switched to natural gas:

Carbon emissions would drop by 30% per truck.

U.S. oil imports could be cut by 3 million barrels per day—slashing OPEC imports by over 60%.

Fuel costs would drop, benefiting both industry and consumers.

Natural gas consumption in this sector could be a cornerstone for U.S. natural gas consumption growth and a key step toward energy independence.

Natural Gas as a ‘Bridge Fuel’—But Bridge to What?

Natural gas is often called a bridge fuel: cleaner than coal or oil, but still a fossil fuel. The idea is to use it as a stepping stone while renewable technologies mature. As one industry leader reflects, “Natural gas is the bridge fuel, is the way I see it… But when you look at the natural gas we have, it could very well be the bridge to natural gas, because you have plenty of natural gas.”

Yet, the story isn’t all rosy. The surge in natural gas production and plummeting prices have unexpectedly undercut wind power investments, showing that even bridge fuels can disrupt the path to renewables.

America as a Net Energy Exporter

Since 2019, the U.S. has become a net energy exporter, largely due to the expansion of natural gas. This shift has changed global energy dynamics and strengthened U.S. energy security.

Windmills, Losses, and Why Not All Green Dreams Pay Off

For a while, wind energy looked like the next big thing in renewable energy investment. Visionaries and investors poured billions into wind farms, betting that clean power would soon outpace fossil fuels. But as the story of one famous energy tycoon shows, the path to a greener future is anything but smooth. Sometimes, even the boldest green dreams run smack into the hard wall of market reality.

Take the case of the Pickens Plan—a high-profile push to turn America’s heartland into a sea of wind turbines. At first, the math worked. Natural gas prices hovered around $9 per million cubic feet (MMCF), making wind power a competitive alternative. But then, almost overnight, the economics flipped. Thanks to a surge in fracking and new extraction technologies, natural gas prices crashed to just $2.40/MMCF. Suddenly, wind deals that needed gas to stay above $6/MMCF were dead in the water.

"I lost $150 million. That’ll make you abandon something."

That’s not just a line—it’s a lesson. When the person behind the plan admits to losing $150 million, it’s clear that even the most seasoned experts can get burned by the unpredictable tides of energy markets. The reason? In the U.S., power prices are set by the marginal cost of the cheapest available source—usually natural gas. When gas is cheap, it drags down the price of electricity, making it nearly impossible for wind projects to compete without heavy subsidies or policy support.

Market Volatility and Infrastructure Realities

The green transition is full of promise, but it’s also full of risk. Market volatility—like the sudden drop in natural gas prices—can wipe out years of planning and billions in renewable energy investment. Infrastructure realities add another layer of complexity. Wind farms need vast stretches of land, new transmission lines, and steady demand. If any piece of that puzzle shifts, the economics can unravel fast.

Energy Exports Growth: A Double-Edged Sword

Ironically, the same innovations that hurt wind power have turbocharged U.S. energy exports. With fracking making gas cheap and abundant, the U.S. has become a net exporter of liquefied natural gas (LNG). In 2022, U.S. LNG exports to Europe soared by 141%, helping allies diversify away from Russian supplies. This energy exports growth is a geopolitical win, but it also means domestic renewables must compete with some of the world’s cheapest gas.

Wind energy’s promise: Once strong, now challenged by cheap gas.

Renewable energy investment: High risk, high reward—but not always a sure bet.

Energy exports: U.S. now leads in LNG exports, shifting global power dynamics.

Market volatility: Can turn a green dream into a financial nightmare overnight.

Shifting to green energy isn’t just a political decision—it’s a high-stakes financial gamble. The lesson? The leap to renewables requires more than wishful thinking. It takes grit, timing, and a willingness to learn from even the most expensive mistakes.

The Double-Edged Sword of Fracking: Innovation or Environmental Pandora’s Box?

Few technologies have reshaped the U.S. energy landscape as dramatically as hydraulic fracturing—better known as fracking. Once a niche technique, fracking has unlocked vast U.S. natural gas reserves, fueling a domestic energy boom and propelling the country to record levels of natural gas consumption and exports. Yet, this innovation comes with a complex legacy, sparking fierce debate over its environmental impact and long-term role in energy policy.

Fracking: A Brief History and Its Transformative Power

Fracking is not a recent invention. The first commercial frack job dates back to 1947, and by 1953, industry veterans were already witnessing its effects in oil-rich regions like Texas. As one seasoned operator recalls:

"I fracked over 3,000 wells in my life. Never had a problem with messing up an aquifer or anything else."

Since those early days, over 800,000 wells have been fracked across the Midwest, particularly in areas above the massive Oglala aquifer. This scale of activity has been central to the U.S. achieving energy independence milestones, with fracking technology enabling access to previously unreachable natural gas deposits.

Environmental Impact: Groundwater, Methane, and the Media Spotlight

Despite its economic benefits, fracking’s environmental impact remains hotly contested. The most common concerns are:

Groundwater Safety: Critics worry that fracking fluids or methane could contaminate drinking water aquifers. However, large-scale studies in the Midwest report minimal direct evidence of widespread aquifer contamination, even after decades of operations. The speaker’s personal account echoes this, especially in Texas and Oklahoma, where fracking has a long track record.

Methane Leakage: Methane is a potent greenhouse gas—far more impactful than CO2 molecule for molecule. Leaks during drilling, production, and transport are a serious climate concern. While the industry has made strides in leak detection and prevention, the risk remains a focal point for environmentalists and policymakers.

Media Focus: Certain regions, especially Pennsylvania, have become flashpoints for media scrutiny. High-profile cases of alleged water contamination and air quality issues have shaped public perception, even as broader data suggests such incidents are rare outside these hotspots.

Comparing Environmental Impacts: Fracking vs. Other Energy Sources

Energy Source | Key Environmental Concerns | Public Debate Level |

|---|---|---|

Fracking (Natural Gas) | Groundwater, methane leaks | High |

Coal | CO2, particulates, mining damage | High |

Renewables (Wind/Solar) | Land use, rare earth mining | Moderate |

Fracking’s double-edged nature is clear: it has powered the U.S. gas boom and shifted global energy dynamics, but its environmental risks—especially methane leakage—keep it at the center of energy policy debates. Its legacy is still being written, well by well, and headline by headline.

What Next? Methane, Innovation, and the Quirky Future of Energy

When it comes to the future of U.S. energy independence, the story is far from over. In fact, the next chapter might be written not in oil or even traditional natural gas, but in something much stranger: methane hydrates. These icy crystals, packed with methane, sit in ocean beds around every continent, representing a massive, largely untapped energy resource. The potential is almost limitless—if we can figure out how to tap it safely and responsibly.

Methane Hydrates: The Sleeping Giant of Energy Potential

Imagine an energy source so abundant that it could rewrite the global energy map. That’s the promise of methane hydrates energy potential. As one industry leader put it, “If you look at the world, you have methane hydrates in the ocean around every continent.” The U.S. alone spends about $1 billion a day on energy outflows, but with methane hydrates, there’s a chance to flip the script—if innovation can keep pace with ambition.

‘Anything American’: Homegrown Solutions for Energy Dominance

For many, the answer to energy independence isn’t just about finding the next big thing—it’s about making sure it’s American. The speaker’s mantra, “I’m for anything American,” underscores the belief that energy policy and national security go hand in hand. The next leap in energy dominance must be built at home, not imported. This mindset fuels a willingness to invest in new technologies, even when the payoff isn’t guaranteed.

Natural gas is the bridge fuel…because you have plenty of natural gas.

Natural gas, and by extension methane, is seen as the bridge to the future. But as the speaker admits, “How in the hell can we get off the natural gas at some point?” That’s the challenge for the next generation of innovators.

Investing in Innovation: Patriotism Over Profits

Energy independence isn’t a finish line—it’s a moving target that demands constant innovation. Sometimes, that means taking risks and accepting losses. “I lost one hundred and fifty million on the wind,” the speaker confesses, but the willingness to invest in the unknown is framed as a patriotic act. The real question: Are we ready to back bold ideas, even if they don’t maximize profits right away, but might secure the future health of the planet?

Wild Card: The Quirky Future of Methane

Picture this: trucks powered not by Texas shale, but by methane harvested from the deep ocean. It sounds like science fiction, but with the right breakthroughs, it could be tomorrow’s reality. The transition to natural gas is necessary, but it’s not the endgame. Future fuels will be invented, not inherited.

Right now, there’s no real U.S. energy plan—just a patchwork of policies and a lot of hope. Leadership and public will are needed to bridge the gap between what’s possible and what’s practical. The endpoint of U.S. energy independence isn’t just technical—it’s about daring to try, fail, and try again for the next big leap.

Table & Chart: U.S. Oil & Gas—Dependence, Transition, Possibilities (All in the Numbers)

Numbers tell stories—sometimes, they even write history. When it comes to U.S. oil and gas, the numbers reveal not just our past choices, but the crossroads we face today. A century ago, America chose crude oil over whale oil and coal. Now, with global energy demand set to double by 2040, the U.S. stands at another decision point. The choices we make about U.S. natural gas consumption, oil imports, and energy policy will shape not only our economy, but our place in the world.

Metric | Value | Significance |

|---|---|---|

U.S. Oil Consumption | 20 million barrels/day | 25% of global use, with only 4% of world population |

OPEC Payments (Annual) | $1 trillion | Massive wealth transfer, drives foreign policy |

OPEC Payments (Since 1976) | $7 trillion | Largest wealth transfer in history |

Natural Gas Reserves (U.S.) | 4,000 trillion cubic feet | Three times Saudi oil reserves (in energy equivalent) |

Truck Fleet Conversion Impact | 60% reduction in OPEC oil imports | Switching 8 million trucks to natural gas |

Charting the Future: Reserves, Consumption, and the Power of Transition

Imagine a chart: on one side, Saudi Arabia’s claimed 250 billion barrels of oil; on the other, the U.S. with 4,000 trillion cubic feet of natural gas—enough to triple the Saudi figure in energy terms. Now, add the impact of converting America’s heavy-duty truck fleet to natural gas. This single move could slash OPEC oil imports by 60%, cut carbon emissions by 30%, and set a new natural gas consumption record for the U.S. That’s not just a statistic; it’s a blueprint for energy independence and a cleaner future.

The Story Behind the Numbers

These aren’t just dry figures for policy wonks. They’re the reason the U.S. maintains a fleet of eleven aircraft carriers, with most stationed near oil shipping lanes in the Middle East. They explain why energy policy is inseparable from national security, why budgets balloon, and why climate debates matter. Every barrel imported, every trillion sent overseas, is a choice with consequences—military, economic, and environmental.

Numbers as a Call to Action

Clear visualization—through tables and charts—can do more than inform. It can inspire, warn, and nudge the national conversation in new directions. The data above isn’t just historical trivia; it’s a call to action. If America wants to move from dependence to leadership, the path is visible in the numbers: leverage abundant natural gas, rethink transportation fuels, and craft an energy policy that matches our resources to our ambitions.

In the end, the future of U.S. energy independence isn’t written in oil or gas alone. It’s written in the choices we make—choices that, as these numbers show, have the power to determine wars, budgets, and the climate for generations to come.

TL;DR: America’s quest for energy independence is as much about avoiding old mistakes as it is about chasing new solutions. Natural gas is our controversial but realistic bridge, but only a blend of realism, innovation, and maybe a little stubborn optimism will finally break the cycle of dependence on foreign oil.

Comments

Post a Comment